国际经济管理学院研究生workshop 2024年秋季学期第3期

时间: 2024-10-21 03:11:00

研究生workshop由首都经济贸易大学国际经济管理学院主办。主要内容:一是研究生报告前沿或经典文献,二是研究生报告自己的研究或研究设想。论坛宗旨是:为学院师生搭建一个学术交流平台,营造浓厚学术氛围;通过对经典论著或前沿文献的研讨,拓宽研究生的理论视野,提升研究生的前沿方法运用能力,帮助研究生提高论文写作质量。

本期workshop

第二组报告人1:梁思源,博士2022级

导师:高静

报告题目:排污权交易机制是否提高了企业全要素生产率——来自中国上市公司的证据,中国工业经济,2019

摘要:本文利用中国首次大规模的市场型环境规制——2007年SO2排放权交易试点政策——作为准自然实验,研究排污权交易制度对企业全要素生产率的影响, 以检验“波特假说”在中国是否成立。基于省份和地级市层面数据的预评估,本文发现,试点地区的SO2减排和经济增长显著高于非试点地区,排污权交易制度实现了经济与环境的“双赢”。在此基础上,本文运用双重差分法、三重差分法、工具变量法以及一系列稳健性检验,研究发现,排污权交易制度显著提高了试点地区的上市企业全要素生产率,且年度效应滞后两年后逐年递增。进一步的分析表明,排污权交易制度主要通过促进企业技术创新和改善资源配置效率两条途径作用于全要素生产率。从企业所有制类型看,非国有企业比国有企业对排污权交易制度更加敏感;从环境执法力度看,环境执法力度越高的地区排污权交易制度对全要素生产率促进作用越大。本文的发现为中国在环境治理领域进一步推行市场型环境规制有着重要的政策启示。

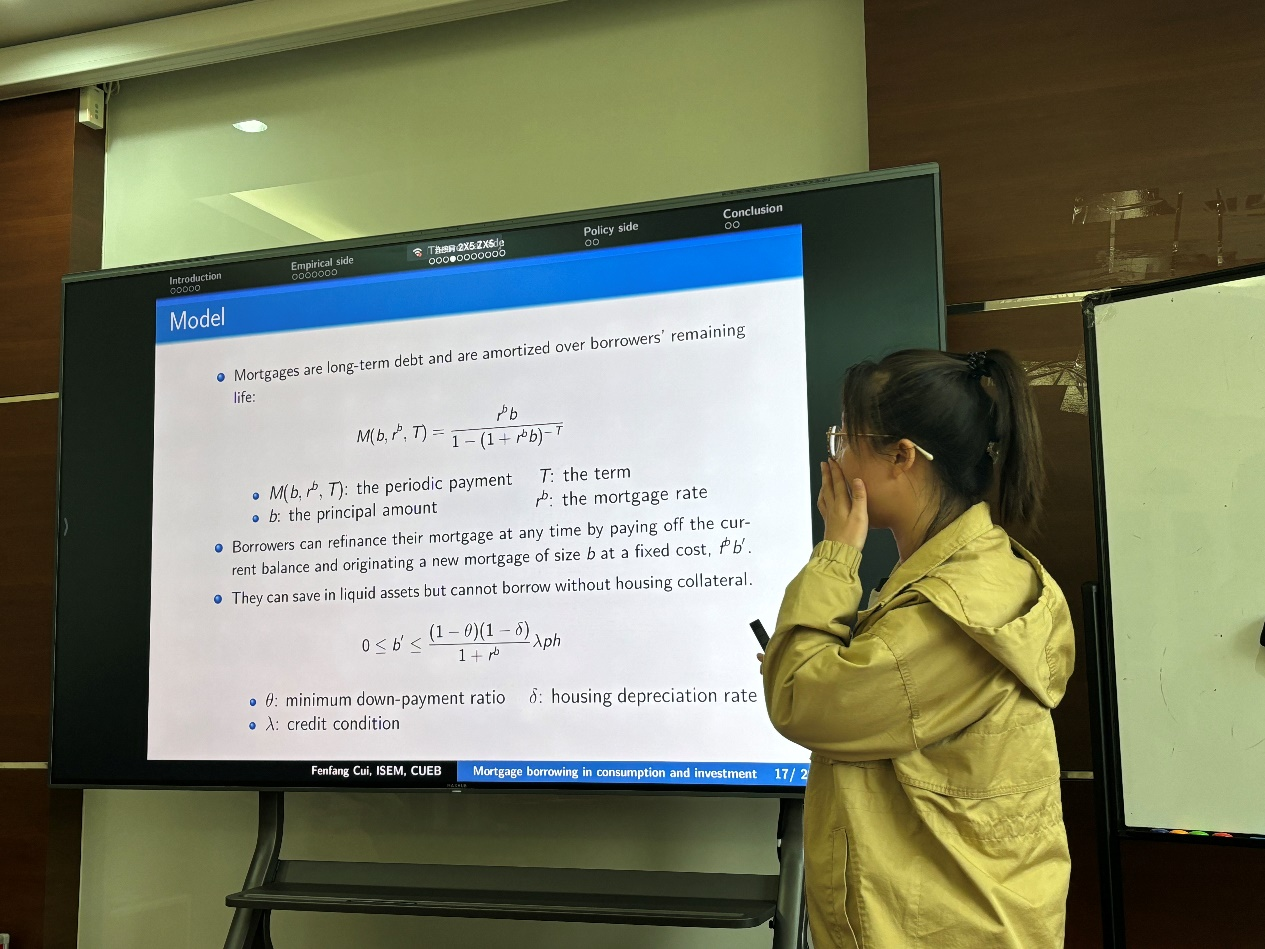

报告人2:崔粉芳,博士2023级

导师:高逸尘

报告题目:Mortgage borrowing and the boom-bust cycle in consumption and residential investment,Review of Economic Dynamics,2021.

摘要:This paper studies the transmission of the major shocks in the U.S. housing market in the 2000s to consumption and residential investment. Using geographically disaggregated data, I show that residential investment is more responsive to these shocks than consumption, as measured by elasticities and the implied contributions to GDP growth. I develop a structural life-cycle model featuring multiple types of housing investment to understand the large responses of residential investment. Consistent with the microdata, the model generates lumpy debt accumulation, lumpy housing investment and a strong correlation between mortgage borrowing and housing investment at the early stage of the life cycle. In the model, households move up the property ladder by increasing their mortgage debt after they have accumulated enough home equity. Since liquidity constraints and fixed costs prevent especially young homeowners from acquiring their desired home, shocks to their borrowing capacity have a large impact on residential investment.

时间:2024年10月18日